Signup Now

Startup Merchant Account

Apply Today, Be In Business Tomorrow

- 99% Approval Rate!

- No Application Fee

- No Setup Fee

- No Contract

- Bad Credit OK

- Fast 24 Hour Approval

- Chargeback Prevention

- Next Day Funding

We at Merchant Marvels specializes in credit card processing services for high risk merchants.

Contact us to increase your sales and pay less in processing fees.

Why Startup is considered as high risk business?

Starting your own business is an exciting endeavor, but it can also be a risky one. This is especially true for startups, which are typically smaller, newer businesses that are trying to carve out a niche in a highly competitive market. One of the main reasons why startups are considered high risk is because of the uncertainty that comes with launching a new business. There are a lot of unknowns when it comes to things like product demand, market competition, and customer behavior, which can make it difficult to predict whether or not a startup will succeed. Additionally, startups often require a significant amount of capital to get off the ground, which can be a significant financial burden for entrepreneurs. Despite the risks, however, many people are still drawn to the idea of starting their own business, and for good reason. With the right idea, team, and execution plan, a startup can become a hugely successful and lucrative venture

Starting a business is never easy. The road ahead is filled with uncertainties that can make or break a new venture. However, when you talk about a startup, the level of risk involved increases tenfold. A startup is a new business venture launched by entrepreneurs that are usually based on a unique idea or concept. They are often fueled by passion, creativity, and innovation, but these characteristics can also be the very reasons why a startup can fail. From lack of funding, market competition, market testing and other factors, the stakes are high in a startup venture. The probability of success is quite slim, which is why startup is considered as a high risk business. It takes a great deal of courage, drive, and resilience to succeed in this field of business.With a startup, the risk factor is significantly higher due to the lack of proven market demand, limited initial funding, and high competition. In addition, startups also have to face the challenge of gaining customer trust and building a brand from scratch. Unlike established companies, startups have no track record, which makes it tough to convince investors and clients to commit. While startups may have a higher potential for profitability, the risk of failure is also high. That is why a vast majority of startups fail: they are simply too risky. Despite these risks, brave entrepreneurs continue to embark on the journey of founding a startup, driven by their passion and the potential of their idea.

What a StartUp Merchant Account need to know...?

Revenue model

The fundamental thing that needs to be understood is the revenue model that processors use. On average the profit margin for merchant services lies within 1% range (off total volume processed). It means that if your company processes $5,000 monthly, then a merchant services company is going to earn about $50 plus any subscription fees that they might want to charge. Consequently, one of the reasons why startup merchants have hard time getting their merchant accounts or why they are forced to pay above-the-average processing fees, is because it takes time and effort for a PSP (processor) to onboard and deal with them, while the profit from their particular account is not very significant.

Location-related risk

The other fundamental concept to understand is the risk. Essentially, if someone is approved to process $10,000, he is given a credit line of $10,000. The reason is you can process your $10,000 worth of transactions, using stolen credit cards, collect your money the next day, and disappear, while whoever issued your merchant account will be responsible for all of the chargebacks. Because of that, as part of the underwriting, issuers of merchant accounts try to minimize the risk of fraud by your customers, as well as by you as a merchant. In, US office and US bank account, because it protects them from many potential liabilities. This is the reason why many of the Asian merchants (located in such countries as India, Pakistan, and others) are unable to get US dollar merchant accounts through US firms.

Nature of business

Managing financial risks related to a business can be tricky, especially in certain industries. Gambling and pornography both carry the risk of illegitimate transactions and chargebacks, requiring greater security measures or increased premiums from acquirers. Development services provided through international outsourcing present another challenge as customer dissatisfaction rates are higher and contractual conflicts become more difficult to resolve due to distance. For businesses operating under such conditions, rigorous attention needs to be paid towards mitigating potential losses.

Increased incidence of chargebacks and fraud

Transactions in the business can occasionally be challenging because this venture is still young. Customers often demand refunds or returns which negatively affects a companies’ standing while increasing the risk level of such a business. . Chargebacks not only result in lost revenue, but they can also damage a business's reputation. It is important for businesses to implement security measures such as encryption and two-factor authentication, and to stay informed about the latest fraud prevention techniques.

Signup Today For a Merchent Marvels Account

What is a merchant account and why do you need one for your new business in the USA

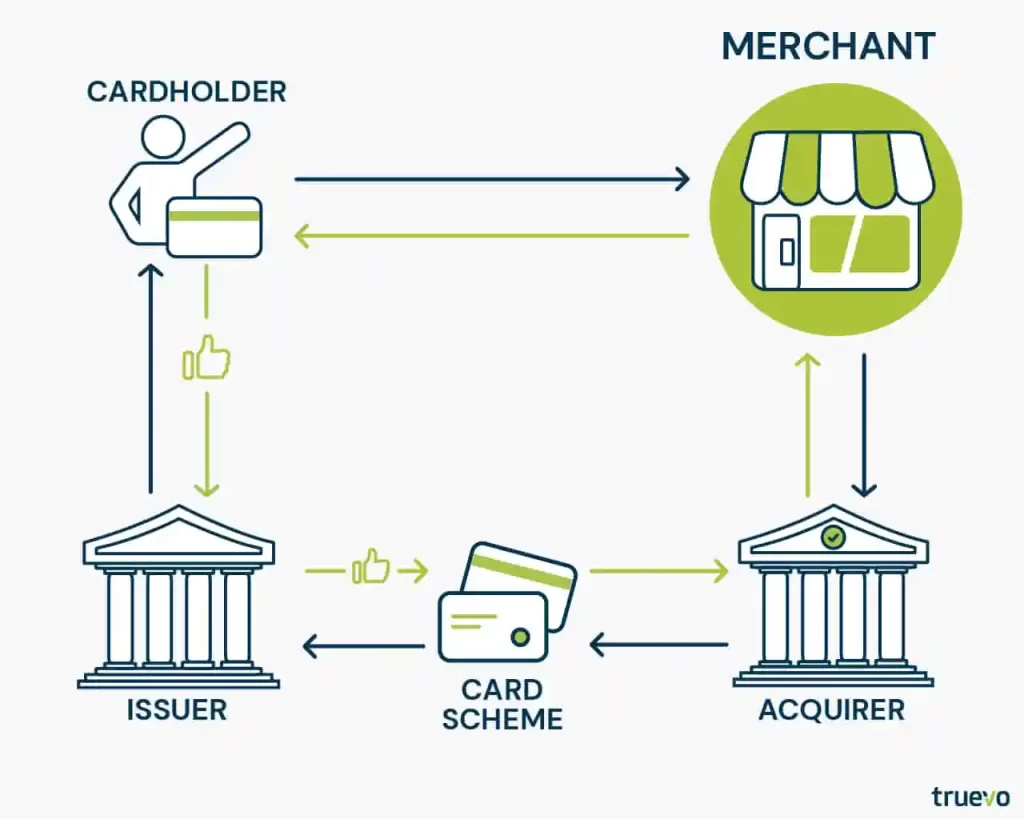

If you’re running a startup business in the USA that requires accepting payments through electronic transactions, a merchant account is an essential tool to have in your business toolbox. But what exactly is it? A merchant account is a type of bank account that enables business owners to accept various forms of payments, such as credit card, debit card, or electronic check payments, from customers. It acts as a mediator between the customer’s bank and the business owner’s bank account by transferring funds from the customer’s account into the business owner’s account. Without a merchant account, your business would be unable to accept electronic payments, potentially losing you valuable sales and customers. So, if you want to stay competitive and keep up with today’s transactions, obtaining a merchant account is a crucial strategy for your startup’s success.

Types of merchant accounts available and how to select the right one for your startup business

As a new business owner, selecting the right merchant account may seem daunting. However, it is crucial to have a merchant account that aligns with the specific needs of your startup. There are various types of merchant accounts available, including traditional, high-risk, and third-party accounts. Traditional accounts are the standard, low-risk option for most businesses. High-risk accounts are for industries or businesses that have a higher probability of chargebacks, such as travel or adult entertainment. Third-party accounts are ideal for businesses that process payments through a marketplace, like Amazon or Etsy. It’s essential to consider the fees, contract terms, and integration capabilities of each merchant account option. Analyze your business needs and select the most suitable merchant account that will best serve your startup’s long-term success.

Signup Today For a Merchent Marvels Account

Signup Today For a Merchent Marvels Account

Choosing the Right Merchant Account Provider for Your Startup

What Makes A Good High-Risk Merchant Account Provider?

StartUp might be considered a “high-risk” business by some banks, but you shouldn’t have to pay a premium for the merchant services you are entitled to. The best account providers…

Don’t charge exorbitant fees

Provide you with the safety/security features you need

Have high acceptance rates

Provide excellent customer service

What To Look For During Payment processing

Not all payment processing gateways are the same. You need the services of high-risk payments experts that:

Handle credit card payments quickly and safely

Issue returns/refunds/partial refunds promptly

Improve the customer experience online/in-store

Benefits of Having a Merchant Account in the USA

Standard benefits:

– Save money on your credit card processing fees.

– Get paid faster with no more waiting for checks in the mail.

– Increased sales and revenue

– Improved customer satisfaction

Emotional benefits:

– Rest easy knowing that your customers’ data is safe and secure.

– Feel proud of your American business!

– Feel more secure doing business with American customers

– Rest assured knowing that your transactions are being processed safely and securely

Signup Today For a Merchent Marvels Account

How to open a merchant account in the USA – step-by-step guide

Starting a business can be challenging, but one crucial step to success is opening a merchant account. This allows you to accept credit card payments and conduct transactions with ease. For a startup business in the USA, it is essential to have a merchant account. However, the process can seem overwhelming, especially if you are not familiar with it. The good news is that you can follow a step-by-step guide to open a merchant account. By following the instructions, you can ensure that your business is ready to thrive in the digital world. Whether you are selling products or services, a merchant account can be a game-changer for your startup business.

In most cases, you must provide specific supporting documents to register for a merchant account. They include:

The organization’s founding documents; information on the management group, stockholders, and secretary;

Information on the company’s status (obtained if they registered the organization no more than 12 months before the application);

a certificate of company information;

details on the refund policy;

Copies of the firm’s extracts

Signup Today For a Merchent Marvels Account

Signup Today For a Merchent Marvels Account

Tips for setting up a successful merchant account in the USA

Setting up a merchant account can be a game-changer for your business in the USA. It opens up a world of payment options and can help increase your revenue. However, it can be overwhelming to navigate the process. To set yourself up for success, there are a few tips to keep in mind. First, do your research on different merchant account providers and compare their fees and services. Second, make sure your business meets the eligibility requirements, such as having a US bank account and a tax ID number. Third, be prepared to provide documentation and answer questions during the application process. Fourth, ensure that your website is secure and compliant with payment card industry standards. Finally, keep your customers’ payment information safe by implementing strong fraud prevention measures. By following these tips, you can set up a successful merchant account and take your business to the next level.

Pros and Cons of merchant account Different Payment Processing Systems

As the world becomes increasingly digital, businesses must adapt to new ways of accepting payments. Merchant accounts are a popular choice for many companies, as they offer a wide range of payment processing options. One advantage is the ability to accept credit and debit cards, which is essential for many consumers. Merchant accounts can also provide faster access to funds than other payment methods, which is beneficial for businesses that need cash flow.

However, there are also some drawbacks to consider. Merchant accounts often come with fees and may require a minimum transaction volume, which can be a burden for small businesses. Additionally, some customers may be hesitant to share their financial information with merchants, which could impact sales. Ultimately, the decision to use a merchant account will depend on a variety of factors, including the nature of the business and its customer base.

What Other Services Might a startup Merchant Account Need?

As a startup merchant in the USA, obtaining a merchant account is a crucial step towards accepting credit card payments. However, a merchant account alone may not suffice in catering to all the financial needs of your business. There are several other essential services a startup merchant account may require. For instance, chargeback prevention services can prevent fraudulent activity and reduce the number of chargebacks filed against your business. ACH processing enables automated clearinghouse transactions, allowing your business to accept bank-to-bank transfers. Additionally, a payment gateway is necessary for securing online transactions, reducing the risk of fraud and ensuring customer data privacy. Therefore, as a startup merchant, it is imperative to recognize the need for additional services to achieve smooth financial operations.

Benefits of Having a Merchant Account in the USA

There are many benefits to having a merchant account in the USA, but perhaps the most significant is the ability to accept credit and debit card payments from customers. This is especially important in today’s digital age, where cash transactions are becoming less and less common. With a merchant account, you not only make it easier for your customers to pay, but you also open up new opportunities to grow your business. For example, you may be able to sell your products or services online, which can significantly increase your reach and revenue. Additionally, some merchant account providers may offer valuable tools and services, such as fraud protection, chargeback assistance, and analytics, to help you run your business more efficiently and effectively. Whether you’re a small startup or an established business, having a merchant account is a smart investment that can pay off in countless ways.