Adult Merchant Account

Apply Today, Be In Business Tomorrow

- 99% Approval Rate!

- No Application Fee

- No Setup Fee

- No Contract

- Bad Credit OK

- Fast 24 Hour Approval

- Chargeback Prevention

- Next Day Funding

We at Merchant Marvels specializes in credit card processing services for high risk merchants.

Contact us to increase your sales and pay less in processing fees.

Signup Now

Why subscription-based businesses are considered high risk

In most cases, especially in e-commerce, retailers discover that their merchant account is a crucial component of their business. Brick-and-mortar businesses have the option of operating only on cash and using a standard deposit account at any bank instead of opening a merchant account.

Subscription-based business, also known as recurring billing, is basically a subscription-based model where a customer signs up for a subscription of a product or service and has it billed every month to his credit or debit card.

Although this is one of the best payment processing methods today, subscription-based merchants are considered high-risk. This classification is based on the following reasons:

Negative option billing

Many subscription-based businesses use negative option billing, which avoids the need to alert customers every time a charge is made to their accounts. Even if it's practical, there is a considerable danger of chargebacks because customers occasionally forget they subscribed to your good or service and submit chargeback claims for unauthorized charges.

High Chargeback Rates

You are a high-risk merchant if your company is subscription-based and has a recurring business model, mostly because your chargeback rates are higher than those of other companies'. Subscription businesses are seen as particularly high-risk due to their propensity for an exceptionally high chargeback ratio, as is the case with many of these industries.

The Newness Of The Industry

Although subscription businesses have been around for a while, most of them didn't start accepting payments online until recently. Banks consider your company to be high-risk due to its inexperience on this kind of platform. Because there isn't any proof to yet that cooperating with your company will be profitable, merchant providers label you as high-risk.

Why it is difficult to get a merchant account for subscription-based business

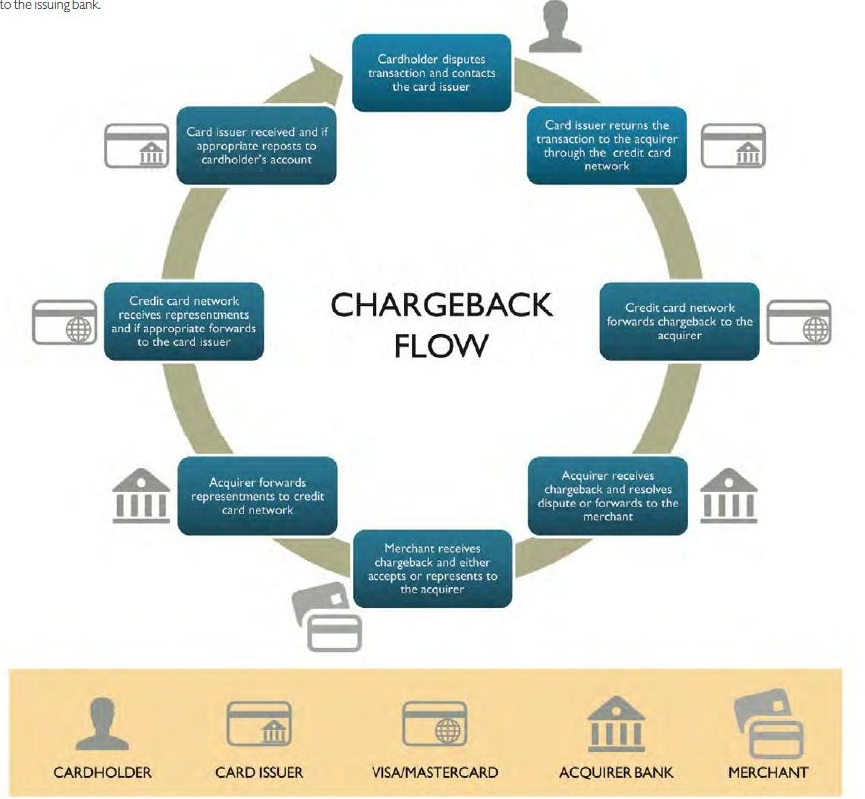

Banks view the price structure of this company model as a risk. They may shut your account once the chargeback rate hits two percent or more since they believe there will always be an excessive risk of chargebacks for the transactions they execute. Chargebacks happen when the customer is required to receive a refund from the bank for their purchase. Every firm should anticipate at least a few chargebacks, but when they start to accumulate, banks will review your account more carefully. Customers may want their money back for a variety of reasons, and dissatisfaction with a good or service is just one of them. Some people decide to create claims because they are unsure or wish to conceal what they purchased (for example, when they get a charge from an adult entertainment company). Or just because they know they can get away with it and they want something for free. Banks always take the side of the client, never that of the continuity subscription merchant. Chargebacks take time and money for merchants since hey frequently have to return the full amount of the payment and pay a fee to the credit card company. Due to the fact that they will be the ones returning your customer’s money in the event of a chargeback, banks are also at risk. When there are too many chargebacks, the bank eventually loses money dealing with you. Bank employees had been informed for years that customers who complained about ongoing subscriptions could only be cancelled by the business receiving the money. But more recently, banking regulators have declared that banks must, almost without exception, cancel them when asked. The credit card companies will always take the customer’s side in these situations and refund their money. Despite the fact that it was not your fault, this leads to a chargeback for your business. When banks notice chargebacks, they become anxious because they think your company is at fault and will face significant dangers.

Many continuity subscription merchants use this charging scenario frequently. Banks have capped the permitted chargeback ratio due to these factors, but the likelihood of chargebacks increases as you sell more (and as your marketing and subscriptions become more successful). Since there is a bigger chance of fraud as a result of higher sales volumes, credit card processors may be wary of your direct marketing continuous subscription business model. Fortunately, by finding a merchant account provider who is familiar with this kind of business structure, problems involving subscription merchant accounts can be reduced and even avoided. In order to sell more subscriptions without worrying that your payment processing account will be suspended or cancelled, High Risk Pay services can set up the necessary frameworks for continued subscription billing and give you a smooth payment gateway.

How the continuity subscription account works

The subscriber’s credit card will be continuously charged under the subscription model until they take steps to cancel it. With subscribers receiving the goods or services without interruption, businesses may offer their services, goods, and solutions on a predictable timetable, which benefits both parties. In addition to improving accounting and budgeting, this also fosters brand loyalty. They also present a plethora of additional business prospects. Banks may view this as a significant risk issue, but High Risk Pay knows that businesses need to use cutting-edge strategies if they want to flourish. By having the required mechanisms in place to reduce chargebacks, fraud, and other scams, we reduce the risk.

Risks associated with the subscription business model

Signup Today For a Merchent Marvels Account

1. Inadequate knowledge of the system

The biggest danger in implementing a subscription business model is failing to recognize how it differs from the conventional model and failing to take the appropriate steps. Businesses must thoroughly prepare all of their business operations to guarantee that everything they perform is focused primarily on providing exceptional value for every consumer.

2. Inability to provide value

If value is not provided, customers will cancel their memberships. People will rather not pay when they are not getting value for their money.

3. Not setting up the right billing and technology

Similar outcomes can occur if one does not invest in and grasp the technologies required to gather and interpret the data that will indicate what clients need. Failure to communicate effectively might cause your clients to demand refunds or chargebacks which is another issue to be aware of that has the potential to be very devastating.

Customers are automatically billed each month under the subscription model, typically as a recurring credit card transaction. This is a convenient process for both the business and the customer, but it needs to be properly watched.

In this line of work, there’s been a greater than usual drop rate of regular payments. That is sometimes the result of brazen deception. Sometimes, in other instances, it is due to an expired or erroneous credit card. Either way, too many declines will increase your Chargeback to Transaction Ratio (CTR) and that can have serious repercussions for a business.

Why your chargeback to transaction ratio matters

One-way card manufacturers use a company’s CTR is to decide whether you qualify as one of their high-risk vendors. With your CTR, they can see how well you’re managing fraud protection and updating card information. You will be added to a watch list and subject to higher credit card processing fees if your CTR exceeds the one percent cutoff. Companies employing the subscription model must regularly monitor credit card information to lower the possibility of chargebacks. This entails highlighting cards that are about to expire and requesting that customers update their information. Additionally, make it simple for customers to contact you with inquiries prior to disputing a charge in order to prevent denied transactions brought on by customer confusion (i.e., they don’t recognize the billing name of your organization). Look for payment processors and card vendors with reliable chargeback management systems to prevent fraud from negatively affecting your CTR. All chargebacks are promptly flagged by these software solutions so the business may take fast action to fix the issue. And the most effective software use AI algorithms to spot probable fraud. They continuously watch all transactions for suspicious trends or other warning signs. Top subscription businesses have the staff and procedures in place to deal with chargebacks and keep an eye on them so they don’t affect the company’s bottom line.

Look for payment processors and card vendors with reliable chargeback management systems to prevent fraud from negatively affecting your CTR. All chargebacks are promptly flagged by these software solutions so the business may take fast action to fix the issue. And the most effective software use AI algorithms to spot probable fraud. They continuously watch all transactions for suspicious trends or other warning signs. Top subscription businesses have the staff and procedures in place to deal with chargebacks and keep an eye on them so they don’t affect the company’s bottom line.

How you can keep chargeback down in subscription-based business

You can take a few steps to try to limit chargebacks for your subscription services. A few of these are:

Correct pricing

Make sure your pricing is correct at all subscription levels. For instance, following a trial or introductory offer, invoicing will resume at standard rates

Refunds

Whenever a refund is requested, it should be given as soon as possible.

Replacement alternatives and fixes

Make sure you offer a compelling alternative or replacement if a consumer is dissatisfied with a product you sent as part of your subscription.

Returns and Cancellations

You should always make your return and cancellation policy clear and transparent. Making sure everything is absolutely clear can help you minimize complaints and encourage repeat business from your clients.

Be in touch with your clients

It's crucial to be available for your clients, which includes having someone on hand to respond to inquiries, whether in person or via phone or email, depending on your industry. You can do a lot to foster a sense of trust and goodwill with your consumers by promptly responding to emails and phone calls.

Be in touch with your clients

Ultimately, using a high-risk merchant account specialist is one of the best strategies to avoid chargebacks. Several user-friendly payment tracking tools are available from Bankcard, so you can keep track of every transaction from the point of sale until it is successfully completed. In order to protect you from scams, Bankcard also provides a secure payment mechanism with encoding and encryption.

Signup Today For a Merchent Marvels Account

How to apply for a subscription merchant account

One of the quickest methods to apply for a subscription merchant account is to do so through the website of a subscription merchant account payment provider, where an application may be uploaded alongside supporting documents. It doesn’t cost anything, and there are no commitments involved. After that, you will go through the underwriting procedure, at which time you will be requested for information regarding your business, including its processing history and bank statements. Your processing history is crucial in this context because it is one of the factors that can influence the rates offered to you. Prepare yourself for the due diligence that will be conducted by professionals in risk management, who will assess whether or not your company is eligible for a subscription merchant account. Whether you are a non-technical person or you have developers working for you, keep in mind that the onboarding process and the integration process must both be completed in a very short amount of time and be relatively straightforward. Find a payment processor that can handle recurring payments and has a simple yet powerful application programming interface (API). Finally, before you put your signature on a contract, you should read it well to ensure that there are no hidden costs or expenses (such as setup or monthly fees).

How chargeback affects continuity or subscription based business

When customers request a refund on their credit cards because they are dissatisfied with a good or service, this is known as a chargeback. At least that is the theory behind chargebacks, but sadly, a growing proportion of chargebacks are caused by a phenomenon known as “friendly fraud.”

Friendly fraud has occurred when a consumer asserts that they didn’t authorize a credit card charge or that it was made fraudulently. In fact, these are frequently valid allegations, and credit card processing businesses are more than happy to assist. However, in a scenario of friendly fraud, the consumer actually made the purchase but either had second thoughts about it or wished to conceal it (as in the case of a charge from an adult entertainment company).

In cases of friendly fraud, the client would often go directly to the credit card provider rather than the retailer to request a refund.

Due to cancellations, subscription merchant services are particularly vulnerable to chargebacks, including friendly fraud. Customers may decide against a subscription or discover that they are no longer able to afford it. A subscription price may also increase dramatically in some circumstances after the first few months.

A cancellation is equivalent to a chargeback in the subscription market, where everything depends on an effective recurring billing model and has a significant negative impact on income.

Signup Today For a Merchent Marvels Account

How to choose a merchant service provider for a subscription business

You must choose a reliable merchant account provider if you want to handle subscription billing. Many SaaS businesses make the mistaken assumption that the lowest-cost merchant service provider is the best option. Price should not be the only or the key consideration. It is crucial to evaluate the merchant fees to make sure you will still have healthy margins after deducting the costs. Here are some ideas to aid you in making this critical choice;

Your business needs- The following questions should guide you on the merchant service provider to choose:

Do you accept check payments from your customers?

Do you accept payment through credit or debit cards?

Will you accept direct deposit from your customers?

Will you need a shipping address when you complete the transaction?

Customer preferences-

Solutions are offered to customers by successful firms. Consider your clients’ preferred payment methods and develop strategies that meet their requirements. To expand your market and foster consumer loyalty, you must make it simple for people to pay for your services.

Costs-

Take into account the merchant service provider’s associated charges. You will pay a fee because you are enabling online credit card, debit card, and check payments from your clients.

The company’s reputation-

For the operations and image of your firm. Check to see if the business adheres to best practices and is PCI-compliant while accessing, storing, and retrieving consumer credit card information.

Customer service and support- You will undoubtedly run into a lot of issues with your merchant account after signing the contract. Perhaps the billing system as a whole isn’t functioning as it should or the API isn’t integrating with your application. The system may occasionally make mistakes like double charging your customers’ credit cards; if you don’t fix this, your company may experience a high rate of chargebacks and dissatisfied clients.

What kind of response can you expect from the merchant account provider if there are issues with the merchant system?

With online businesses, clients can transact on your website around the clock. Will the merchant be accessible whenever you need support?

When your shopping cart malfunctions over the holidays, will the retailer still be open?

Support is essential to making sure that your business runs properly. Look for a merchant provider with comprehensive documentation available through online forums and live assistance. When you contact a business, you don’t necessarily want to receive an automated response. A company where you can speak to someone immediately on the phone or via live chat is ideal for signing up with.