Signup Now

High Risk Merchant Account

Apply Today, Be In Business Tomorrow

- 99% Approval Rate!

- No Application Fee

- No Setup Fee

- No Contract

- Bad Credit OK

- Fast 24 Hour Approval

- Chargeback Prevention

- Next Day Funding

We at Merchant Marvels specializes in credit card processing services for high risk Business.

Contact us to increase your sales and pay less in processing fees.

What is a high-risk merchant account?

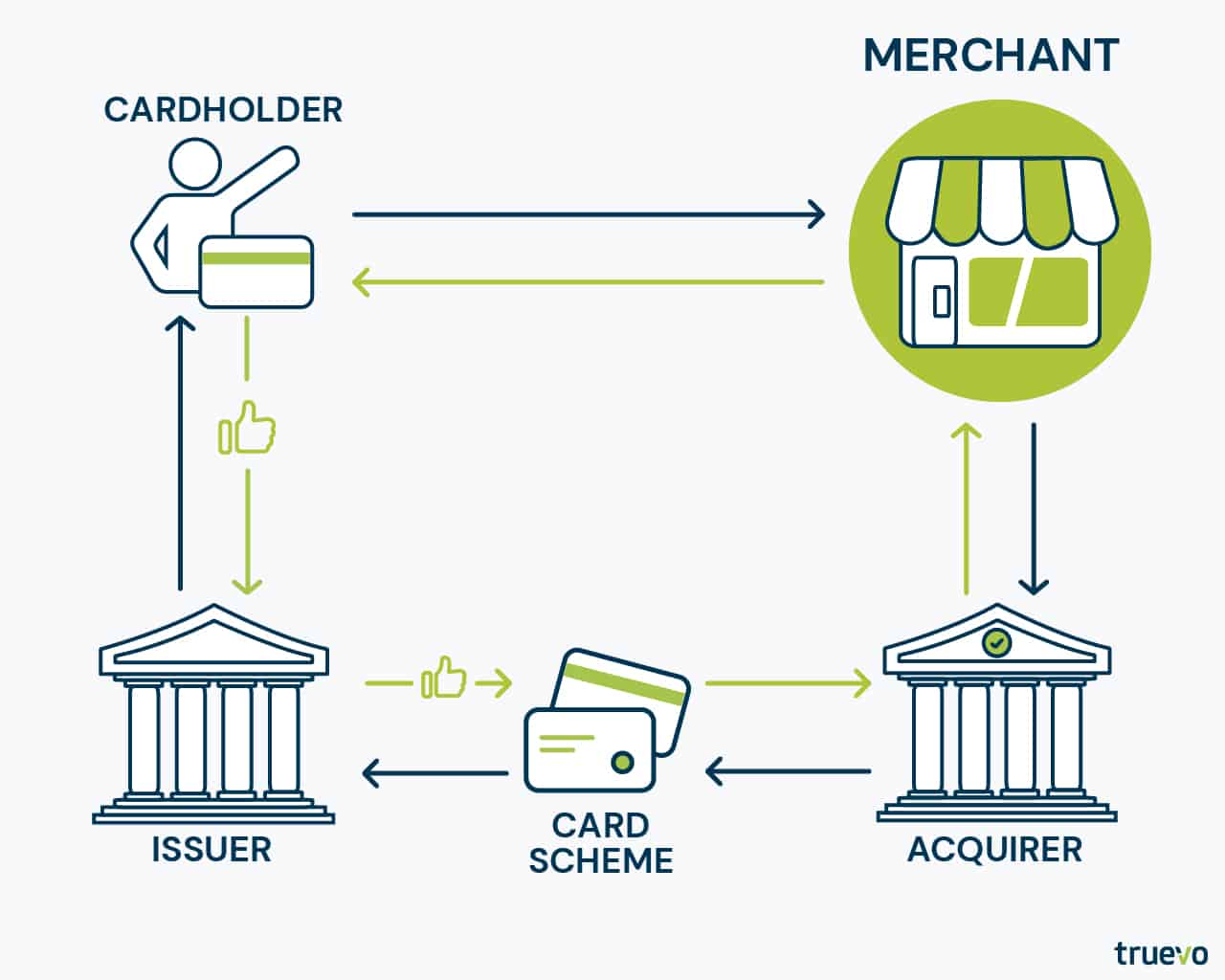

When a payment processor determines that your company account is more likely to have chargebacks, fraud, or a significant number of returns, they classify the account as high-risk. This may be the case for various reasons, such as the fact that you are a new merchant that has never accepted payments before or if your industry is regarded as high risk and has a high probability of fraud. To cover this risk, processing costs are greater for high-risk merchant accounts.

High-risk merchant accounts will always be charged more, even though each credit card processing platform differs. Processing fees will frequently be higher and, in some circumstances, double those of low-risk merchant accounts for all transactions. High-risk businesses also pay higher chargeback costs (fees you pay when a customer rejects a transaction with their credit card directly).

High-risk merchants frequently have to enter into contracts with lengthier duration and pay an early termination, monthly, or annual charge. The payment processor may withhold a portion of earnings from high-risk merchant accounts while verifying that your transactions are valid and unlikely to result in a dispute. This practice is known as a rolling reserve.

What businesses are considered high risk and why?

No centralized framework or body decides which factors make a business high-risk in the payments sector. Instead, each bank, payment service provider, and payment processor create its criteria.

You may be considered high-risk by a payment processing platform for various factors, some of which may be more covert than others. The type of industry that your organization falls under will play a significant role in deciding the risk associated with your business. It’s essential to know beforehand whether your sector is regarded as high-risk so you can make appropriate plans.

The companies listed strictly to rigorous regulations guiding their operations. From concern of reputation to health and safety risks and servicing clients with bad debt, each of these companies is considered high-risk. Why?

Types of Businesses Considered High-Risk

- CBD

- Adult Industry

- travel services, such as airlines, cruise companies, and trip organizers

- Electronic and furniture stores

- Gambling

- Online dating

- E-commerce

- Startup Businessj3

- Subscription services and companies with recurring payment plans

- Collection of debt

- Credit Repair

- MLM Credit Card Processing

- Guns and Firearms

- Nutraceuticals & Supplements

- Vape, and E-cigarette stores

- Business with high volume

New merchant

Merchants that have never received payments before or who have only processed a small number of transactions in the past may be considered high-risk simply because they lack experience.

Bad credit score

Payment processors might view the merchant as high risk if the merchant has a low credit score.

Receiving foreign payments

If a business sells to foreign clients who live in countries with high fraud risk, they may be referred to as high-risk customers (any country except the U.S., Canada, Japan, Australia, or European countries).

New merchaaA substantial volume of transactionsnt

A company may be considered high-risk if it conducts many transactions or has a high average transaction rate. It may be deemed high-risk if a business processes more than $20,000 in payments each month or if the average transaction is $500 or more.

High-risk industry

A merchant may be considered high-risk even though they have an impeccable track record because the industry they serve is more prone to fraud, refunds, and chargebacks. For instance, businesses that rely on subscriptions are categorized as high risk because many clients join up for a trial period only to forget to stop paying. When they analyze their statements and find the forgotten expenditures, they frequently charge back the original amount.

Signup Today For a Merchent Marvels Account

Consumers fully anticipate a convenient, secure, and safe experience when they shop online. Working with a payment provider that enables you to handle online credit and debit card payments while offering your online consumer base a seamless experience is crucial for e-commerce merchants.

Payment processors often classify e-commerce businesses as high-risk. In most cases, this is due to the constantly unpredictable nature of their assets. However, other factors influence this, and they include:

What does Cardholder Not Present (CNP) mean?

Face-to-face interactions and CCTV capture help verify ID and spot some fraudulent transactions in advance, but none of these fundamental fraud defenses are present for online commerce. Every single one of them is “card/cardholder not present.” This growing pattern is being matched by identity theft. Fraudsters are continuously coming up with innovative internet techniques to steal other people’s financial and personal information. These data thieves often exploit stolen information to make transactions online instead of in person. Because of this increasing incidence of data theft, many payment processing organizations are unwilling to work with e-commerce merchants.

How to open a high-risk merchant account

Before choosing a payment processor, you’ll want to read the contract carefully, as every bank and payment processing platforms differ and have different terms for the merchants that they have deemed high-risk.

In most cases, you must provide specific supporting documents to register for a merchant account. They include:

The organization’s founding documents; information on the management group, stockholders, and secretary;

Information on the company’s status (obtained if they registered the organization no more than 12 months before the application);

a certificate of company information;

details on the refund policy;

Copies of the firm’s extracts.

You will also need to provide personal records, as creating a business account would be difficult without one. In this situation, you’ll require:

Proof of residency

A notarized copy of an identity card

A bank recommendation

All the documents on this list are necessary to open a merchant account. You should provide as much information as possible about yourself and the business to the financial institution or processing center where you intend to apply to register an account. In the future, they will be checked for authenticity, and the organization’s activity will be examined for legality.

- The organization’s founding documents; information on the management group, stockholders, and secretary;

Signup Today For a Merchent Marvels Account

However, before choosing a payment processor, you’ll want to read the contract carefully, as every bank and payment processing platforms differ and have different terms for the merchants that they have deemed high-risk.

In most cases, you must provide specific supporting documents to register for a merchant account. They include:

The organization’s founding documents; information on the management group, stockholders, and secretary;

Information on the company’s status (obtained if they registered the organization no more than 12 months before the application);

a certificate of company information;

details on the refund policy;

Copies of the firm’s extracts.

You will also need to provide personal records, as creating a business account would be difficult without one. In this situation, you’ll require:

Proof of residency

A notarized copy of an identity card

A bank recommendation

All the documents on this list are necessary to open a high risk merchant account. You should provide as much information as possible about yourself and the business to the financial institution or processing center where you intend to apply to register an account. In the future, they will be checked for authenticity, and the organization’s activity will be examined for legality.

What is the difference between high-risk and offshore merchant accounts?

Signup Today For a Merchent Marvels Account

A high-risk merchant account is one that a payment processor considers a high risk of payment chargebacks or fraud. This account can either be in your country of residence or a country outside your country of residence (offshore merchant account). To offset the risk the payment processor is taking on; high-risk merchant accounts pay higher payment processing costs.

On the other hand, offshore banking involves opening a bank account outside your country. This banking method is often more difficult than opening a domestic bank account since you might need to demonstrate that you have a certain quantity of money or a business connection to the country where the bank is located.

An offshore merchant account is opened with a bank outside of your native country that enables its customers to accept online credit card payments. Business owners in different sectors can use an offshore merchant account.

Also known as an international merchant account, it can benefit multinational retailers or businesses that sell goods to customers across borders. These businesses are required to offer real-time credit card processing in those customers’ native currencies. To process credit cards safely and securely, they must collaborate with other nations’ banks. These important goals can be accomplished by merchants using offshore merchant accounts.

Signup Today For a Merchent Marvels Account

Is it possible to get a high-risk merchant account with instant approval?

Signup Today For a Merchent Marvels Account

Trade business visionaries frequently require an moment dealer account. A few dealer accounts are speedier than others, in spite of the fact that none offer moment endorsement. Moment endorsements don’t exist for any vendor administrations account. It more often than not takes longer to favor a high-risk vendor account than it takes to favor a low-risk trade account. Why? High-risk vendors altogether explore your capacity to preserve the save sum vital for your account. Both your claim and your company’s managing an account histories will be analyzed by installment processors. It is essential to offer more necessities, which may experience more departments’ and auditors’ examinations than normal. The audit of these archives can take a few days. What does “instant dealer account approval” really suggest, then? “Instant” in this case alludes to a entire day or two, which is distant quicker than the standard strategy. The larger part of account suppliers utilize a two-step endorsement process. Your account is at first endorsed by the pr

What are the fees for high risk merchant account? Why

are there higher fees on high risk merchant account?

Keeping your account secure is the main goal of PCI compliance. Customers expect the strict security that comes with this designation when you tell them that your company is PCI compliant.

If your payment processor charges a fee for PCI compliance, they better have this service included.

Every component of your processing system, including your website, payment gateway, card terminals, server, etc., should be properly scanned by PCI compliance security services for viruses, malware, and other potential risks.

Your system must be scanned at least once every three months to stay PCI compliant. Some suppliers will even offer to perform this on a monthly basis, assisting you in continuously staying up to date with all of your security requirements.

The smoothest and most cost-effective operation of your high risk merchant account depends on having a trusted and experienced payment processor. When it comes to paying the charges Associated with consumer refunds, certain processors can be rather obstinate, and you run the danger of getting overcharged for both payment processing and refunding transactions if you don't use a single provider to manage your business operations.

PCI Compliance Fees differ from processor to processor. This often depends on some factors. It is important to read the fine print of the service providers contract to understand if they offer PCI compliance services and if you are being charged or not.

In some cases, the service provider provides PCI compliance services and you are charged, or the service provider provides PCI compliance services and you are not charged, the service provider does not provide PCI compliance services and you are charged.

Carefully reading the fine print can help you determine if this is a legitimate cost or not. In the case that your provider charges a PCI compliance fee, you’ll either be charged on an annual or monthly basis.

Payment processors typically provide these PCI compliance services

This service is one of the most crucial. If your payment processor includes "customer education and assistance" in their PCI compliance service, you may be able to benefit from an extensive base of resources that will inform you of PCI compliance standards and provide support in the event that security vulnerabilities are found.

Be sure to discuss with your selected provider how to get the most out of the PCI compliance service.

If insurance is included in your PCI compliance fee, you'll be compensated for any damages or claims due to data breaches where your customers' personal information was either lost or stolen.

This is, however, subject to legal restrictions and operates within a set of exclusions, so your insurer can decline to pay for your data breach claim

The chargeback was intended to safeguard customers in cases of fraud, when they did not receive ordered goods, etc. However, many consumers have learnt to take advantage of this system, leading to the development of what is known as friendly fraud (where a customer files for a chargeback without having a legitimate reason to do so).

In this case, the law is not on the merchants' side because they are presumed guilty unless they can demonstrate their innocence. As a result, chargeback fees and customer reimbursements will be deducted from your account automatically — no ifs, ands, or buts.

These fees don’t seem excessively high at first, but they can add up quite quickly, becoming a real dam in your revenue stream.

Much like a security deposit, the chargeback reserve serves as the acquiring bank's insurance against financial loss, much like an escrow fund might.

The 3 most common types of reserves include:

- Rolling Reserve

For a rolling reserve, a portion of each credit card deposit—probably between 5 and 10 percent—is kept in a reserve for somewhere between six months and a year. When the specified duration is over, the reserved funds are sent back - monthly - to the merchant.

- Up-Front Reserves

This sum of money must be put into escrow when you sign an agreement, and that constitutes this form of reserve.

- Capped Reserve

A certain percentage is taken off every transaction until the agreed-upon amount is reached. This amount is usually about half of your business' monthly volume. The capped reserve is held until your merchant account agreement expires.

If you terminate your account earlier than the agreed date, you are liable for an early termination fee. This fee is estimated as the cost the payment processor will incur as a result of the early termination of your contract.

The common variants of this fee are:

- Flat Fee

This is a pre-set amount that is to be paid upon the early termination of your account.

- Liquidated Damages

If you agree to this, you might have to pay a significant amount of money if the contract is terminated early. If, for instance, you sign a 6-year contract and cancel it 2 years into the agreed duration, you will have to pay 4 years’ worth of processing costs as penance.

It’s important that the terms of the termination fee are well discussed and decided upon before signing any documents.

Chargeback fees

Charge back fees on high-risk merchant accounts are usually higher than low-risk equivalents. Payment processors often impose these incredulous fees to dissuade their customers from getting excessive charge backs.

Retained or Rolling Reserve

Although this is not a cost in the real sense, the payment processor may retain a percentage of each transaction as insurance against potential losses in the future. Rolling, upfront, and cash reserves are prevalent and can significantly impact your cash flow.

Interchange-Plus Pricing

The card processor increases every cost related to processing a specific card type by a fixed percentage (for instance, $0.35 to 2.00%). This is the buy-rate percentage (e.g., 2.0%-3.5%) paid to the card networks.

Why offshore merchant is also considered high risk

Signup Today For a Merchent Marvels Account

An offshore merchant account can also be considered high risk because offshore merchant accounts can sometimes be less financially secure. Banking abroad has traditionally been riskier than banking domestically.

Possible risks associated with offshore banking include:

Higher charges relative to ordinary merchant accounts, especially with offshore payment processing.

Some offshore merchant service providers demand that a company representative travels to their operation country to open a merchant account.

Legal disputes can be challenging to resolve.

However, many multinational corporations and high-risk merchants engage in legal offshore banking activities. Therefore, it is crucial that you conduct thorough research before engaging in an offshore banking venture.

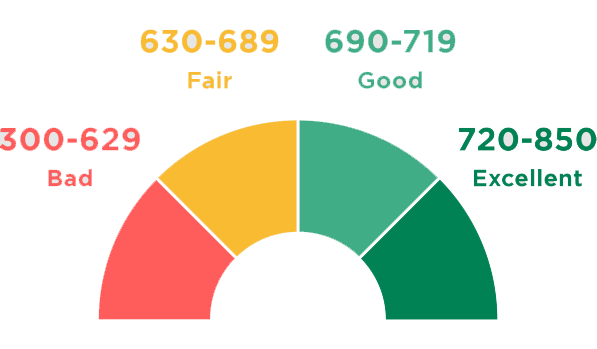

While there’s no straight answer to this, if you need a high-risk merchant account, you need at the very least be in good standing. When applying for a merchant account, credit is a key consideration. It provides issuers with information about your financial dependability and the degree of confidence they should have in you and your company.

Through the use of the business owner’s social security number, business credit is directly linked with their personal credit score. This implies that if you personally have bad credit, your business does too.

Signup Today For a Merchent Marvels Account

A credit score between 800 and 850 is considered exceptional. Any merchant account should be expected to be approved for those with a score in this range. With a score of 740–799, your chances of getting your merchant account application approved by acquiring banks, debit card and credit card processors are very strong. From 670-739 is where things start to become tricky. If your score falls within this range, the merchant services provider will probably take your pattern from earlier months into account to determine which way your score is moving.