Apply High Risk Merchant Account Today

APPLY TODAY, BE IN BUSINESS TOMORROW

- 99% Approval Rate!

- No Application Fee

- No Setup Fee

- No Contract

- Bad Credit OK

- Fast 24 Hour Approval

- Chargeback Prevention

- Next Day Funding

We at Merchant Marvels specializes in credit card processing services for high risk Business.

Contact us to increase your sales and pay less in processing fees.

Sign Up Now For Free

Reasons to Hold a Merchant Account

Own A Wireless Terminal

The future is here with wireless network and store & forward technology. Process payment wherever you are.

E-Commerce Online Store

Our e-commerce solutions provides you with access to the best set of tools, no matter the size of the business.

Virtual Terminal

In e-commerce, a virtual terminal is a Web-based solution that allows merchants to process credit card transactions. It is an alternative to a swipe machine.

What is a high-risk merchant account?

When a payment processor determines that your company account is more likely to have chargebacks, fraud, or a significant number of returns, they classify the account as high-risk. This may be the case for various reasons, such as the fact that you are a new merchant that has never accepted payments before or if your industry is regarded as high risk and has a high probability of fraud. To cover this risk, processing costs are greater for high-risk merchant accounts.

High-risk merchant accounts will always be charged more, even though each credit card processing platform differs. Processing fees will frequently be higher and, in some circumstances, double those of low-risk merchant accounts for all transactions. High-risk businesses also pay higher chargeback costs (fees you pay when a customer rejects a transaction with their credit card directly).

High-risk merchants frequently have to enter into contracts with lengthier duration and pay an early termination, monthly, or annual charge. The payment processor may withhold a portion of earnings from high-risk merchant accounts while verifying that your transactions are valid and unlikely to result in a dispute. This practice is known as a rolling reserve.

What are the fees for high risk merchant account? Why

are there higher fees on high risk merchant account?

Chargeback fees

Charge back fees on high-risk merchant accounts are usually higher than low-risk equivalents. Payment processors often impose these incredulous fees to dissuade their customers from getting excessive charge backs.

Retained or Rolling Reserve

Although this is not a cost in the real sense, the payment processor may retain a percentage of each transaction as insurance against potential losses in the future. Rolling, upfront, and cash reserves are prevalent and can significantly impact your cash flow.

Interchange-Plus Pricing

The card processor increases every cost related to processing a specific card type by a fixed percentage (for instance, $0.35 to 2.00%). This is the buy-rate percentage (e.g., 2.0%-3.5%) paid to the card networks.

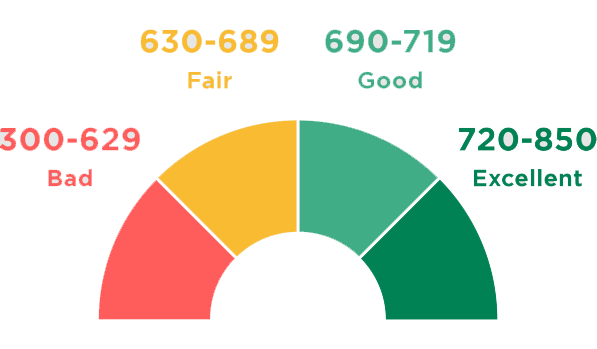

While there’s no straight answer to this, if you need a high-risk merchant account, you need at the very least be in good standing. When applying for a merchant account, credit is a key consideration. It provides issuers with information about your financial dependability and the degree of confidence they should have in you and your company.

Through the use of the business owner’s social security number, business credit is directly linked with their personal credit score. This implies that if you personally have bad credit, your business does too.

Signup Today For a Merchent Marvels Account

Is it possible to get a high-risk merchant account with instant approval?

Signup Today For a Merchent Marvels Account

Trade business visionaries frequently require an moment dealer account. A few dealer accounts are speedier than others, in spite of the fact that none offer moment endorsement.

Moment endorsements don’t exist for any vendor administrations account. It more often than not takes longer to favor a high-risk vendor account than it takes to favor a low-risk trade account. Why? High-risk vendors altogether explore your capacity to preserve the save sum vital for your account. Both your claim and your company’s managing an account histories will be analyzed by installment processors. It is essential to offer more necessities, which may experience more departments’ and auditors’ examinations than normal. The audit of these archives can take a few days. What does “instant dealer account approval” really suggest, then? “Instant” in this case alludes to a entire day or two, which is distant quicker than the standard strategy. The larger part of account suppliers utilize a two-step endorsement process. Your account is at first endorsed by the pr